29/08/2025

What you need to know when importing a car from the UK to Ireland

Importing a car to Ireland from the UK has gotten a little trickier since Brexit. With new taxes and paperwork, the days of just taking a ferry and driving back with a deal are long gone. However, UK imports to Ireland continue to be a great choice for many Irish buyers due to their larger market and the possibility of finding amazing deals on unique or high-spec models.

The red tape shouldn't deter you. From locating the ideal vehicle across the Irish Sea to obtaining legal registration and putting it on the road here at home, this guide will help you every step of the way.

Used cars have dark secrets

Reveal them all! Just enter a VIN code and click the button:

How to find the right car in the UK

It's common to start your next car search online. Knowing where to look is beneficial because the UK market offers a huge selection. Well-known websites that list thousands of cars from private and trade sellers, such as AutoTrader.co.uk, eBay Motors, and Motors.co.uk, are great places to start.

Examine the approved used car sections of trustworthy UK dealership websites too for added peace of mind. Even though the sticker price may be a little higher, these vehicles frequently have better buyer protections and warranties included in the sale.

Remember these important points as you browse:

- Check the seller: Check dealership reviews or exercise caution when dealing with unproven private sellers.

- Confirm the documents: Make sure the vehicle has its V5C logbook, which is the UK version of our VRC.

- Avoid "UK-only" specs: Some vehicles have specifications unique to the UK market. This could lead to headaches later with emissions standards or sourcing replacement parts in Ireland. A quick check on Irish forums for the model you're considering can be a lifesaver.

Use carVertical to verify a vehicle’s history before importing

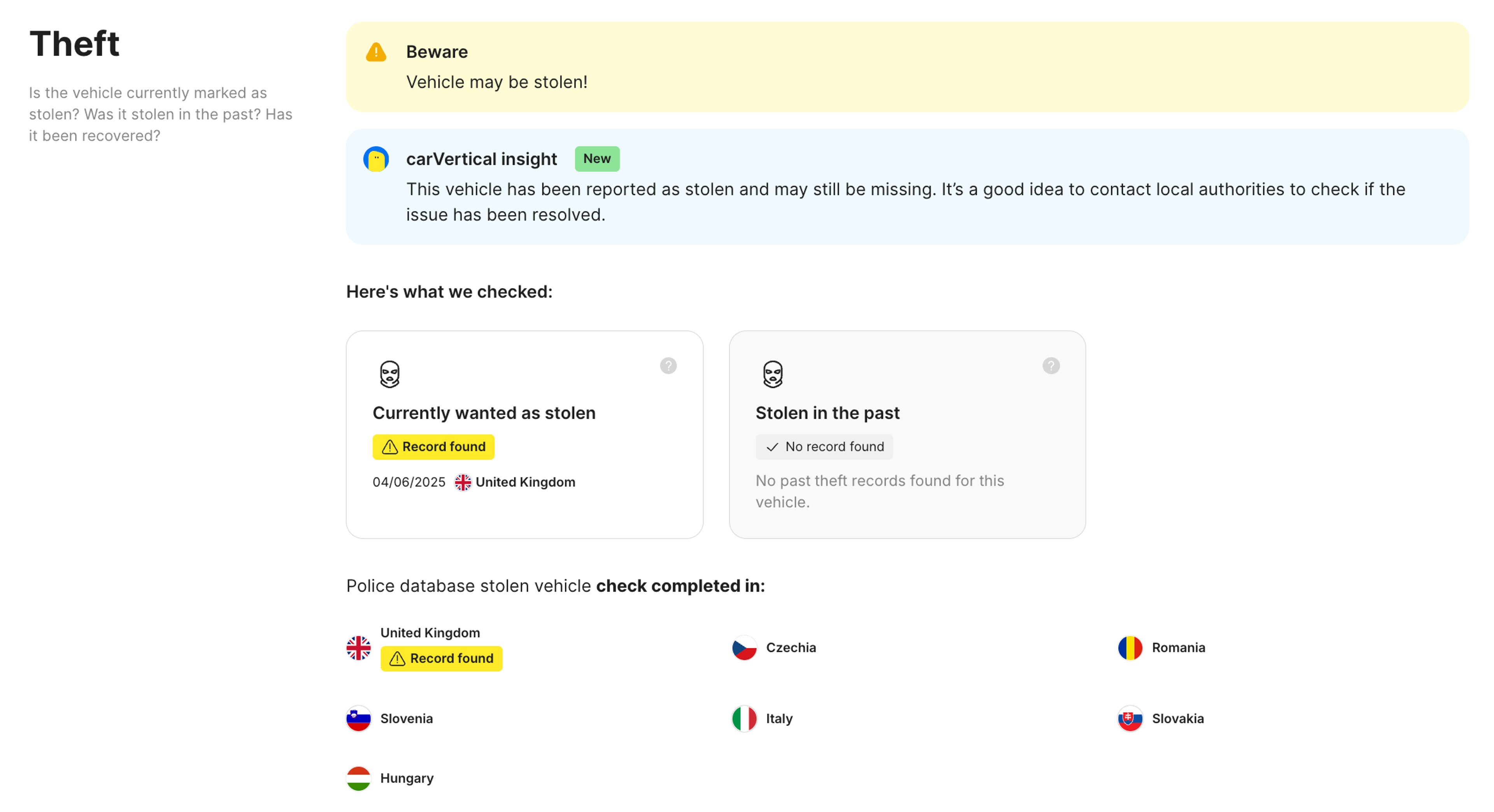

When buying a used car, especially from another country: you only know what the seller wants you to know. A car might look spotless in the photos, but its past could be hiding some expensive or dangerous secrets. This is where a vehicle history report from carVertical becomes an essential tool.

A car history check can uncover critical issues that aren't visible in an online ad or even during a quick viewing. It can flag everything from a stolen vehicle status to outstanding finance, but two of the most crucial checks for any import are mileage fraud and damage history.

Mileage fraud, also known as "clocking," occurs when is illegally rolled back to make the car appear less used than it is. A car with a clocked mileage could be due for major servicing (like a timing belt change) far sooner than you think, leading to unexpected and hefty garage bills.

The report can also reveal if the car has been declared a write-off by an insurance company in the UK (e.g., Cat S or Cat N). Some of these vehicles are repaired and put back on the road, but the quality of the repair can vary massively. An improperly repaired car could be structurally unsafe, and you may have trouble getting it insured in Ireland.

Getting a history check isn’t about being pessimistic; it’s about making an informed decision and protecting yourself from buying a lemon.

Check your VIN

Avoid costly problems by checking a vehicle's history. Get a report instantly!

Physical inspection: what to look for before you buy

Even with a clean carVertical report, nothing beats seeing the car in the metal. If you can travel to the UK to inspect and test drive it, you absolutely should. If a trip isn't practical, consider hiring a third-party vehicle inspection service in the UK. For professional peace of mind, the cost of this is a small price to pay.

Here is a brief list of items to check for, whether you or an inspector is involved:

- Bodywork: Poor accident repair may be indicated by irregular gaps or misaligned panels. Look for paint overspray on the window seals and trim.

- Tyres: Variable tire wear could be a sign of alignment or suspension issues.

- Engine: Keep an ear out for any strange tapping, knocking, or rattle noises when the engine is running warm or cold.

- Interior: Check that all of the dashboard warning lights illuminate when the ignition is turned on and extinguish when the engine is started.

- Paperwork: Make sure the vehicle's mileage and age match those listed in the service history book, which needs to be stamped.

It's risky to skip a physical check. You might have to pay more to fix a hidden problem than the total cost of importing the vehicle to Ireland.

Key costs to consider when importing a car from the UK

To figure out if that UK car is a true bargain, you need to calculate the total "landed" cost. The initial purchase price is just the beginning. When importing a car from Great Britain (England, Scotland, or Wales), be prepared for the following expenses:

- Purchase price: The price you pay for the car itself.

- Vehicle history check: A small but essential cost.

- Transportation: The cost of a ferry and fuel if you collect it yourself, or the fee for a professional delivery service.

- Customs duty: Generally 10% of the purchase price plus transport costs.

- Value Added Tax (VAT): Charged at the Irish rate of 23% on the total value (purchase price + transport + customs duty).

- Vehicle Registration Tax (VRT): A significant tax paid upon registration in Ireland.

- Registration fees: Including the cost of your new Irish number plates.

- Motor tax and insurance: Standard running costs, but essential to make the car road-legal.

Importing a car from Northern Ireland

Thanks to the Windsor Framework, importing a used car from Northern Ireland is much simpler and cheaper. If the car is a "qualifying" vehicle (meaning it was in free circulation in NI), you do not have to pay Customs Duty or VAT. You are still liable for VRT when you register the car in the Republic of Ireland. This makes NI a much more attractive location for UK imports.

Understanding VRT and its exemptions

Vehicle Registration Tax, or VRT, is a tax you must pay when you first register a vehicle in Ireland. It’s a key part of the cost of importing a car from the UK to Ireland and can be a significant chunk of your budget.

VRT must be paid to Revenue at your local National Car Testing Service (NCTS) centre. The amount you pay is calculated based on the Open Market Selling Price (OMSP) of the vehicle, which is the price Revenue determines it would sell for in Ireland. Next, a percentage rate determined by the vehicle's CO2 emissions is applied to this OMSP. The tax increases as emissions rise.

To get an idea of how much VRT is in Ireland, it's best to use the official VRT calculator on the Revenue website.

Let's look at a couple of examples:

- A 2021 Volkswagen Golf (130g/km CO₂): If Revenue gives it an OMSP of €24,000, the VRT rate (22.5%) would result in a tax of €5,400.

- A 2020 BMW 5 Series (145g/km CO₂): With a higher OMSP of, say, €35,000 and a higher emissions band (26%), the VRT could be €9,100.

These examples show how quickly the costs can add up, so always factor VRT into your budget.

Exemptions you might qualify for

In certain situations, you may be exempt from paying VRT. The most common exemption is for those moving to Ireland permanently. Transfer of Residence (ToR) relief is the term for this. To get the exemption, you'll have to prove you're making a permanent move to Ireland. You also need to show you've owned and used the car for at least six months while living abroad.

Remember, you must apply for this relief and get it approved by Revenue before you register the car. Strict conditions and documentary proof are required. You can find full details on Revenue's guidance on VRT exemptions.

Delivery options: bringing your car home

Once you’ve bought your car, the next step is the logistics of getting it from the UK to Ireland. You have two main options.

1.Drive it back yourself: This is often the most cost-effective choice and gives you a chance to get to know your new car on the journey home. You’ll need to book a ferry from a port like Holyhead, Pembroke, or Fishguard to Dublin or Rosslare. Before you travel, you must arrange insurance. Some Irish insurers may provide temporary cover for the journey, but this must be confirmed beforehand. You’ll also need the car to be road-legal in the UK (with valid tax and MOT) for the drive to the ferry port.

2.Hire a professional transport service: You can hire a company from the comfort of home, and ask them to pick up the car and deliver it right to your door for a hassle-free experience. If you're short on time or the car is located in a remote part of the UK, this is a great choice. It is more costly, but it eliminates the trouble of temporary plates, insurance, and ferry arrangements.

Customs, VAT, and import exceptions explained

Depending on whether you are importing from Northern Ireland (NI) or Great Britain (GB), the procedure varies significantly at this point.

Due to post-Brexit regulations, you will be subject to import taxes on vehicles that are imported from Great Britain (England, Scotland, and Wales).

- Customs Duty: This is charged at 10% on the value of the car plus the shipping cost. So, if your car cost €15,000 and shipping was €500, the duty would be 10% of €15,500, which is €1,550.

- VAT: Value Added Tax is charged at the Irish rate of 23%. Crucially, this is calculated on the total of the car's value, the shipping cost, and the customs duty.

These charges are paid to Revenue and are separate from, and in addition to, the VRT. You can find more details on the official Revenue page.

Custom duties on cars from Northern Ireland

Importing a car from Northern Ireland is much more straightforward. Under the Windsor Framework, if you import a used car that is "qualifying" from NI into the Republic of Ireland, you do not have to pay any Customs Duty or VAT.

A "qualifying" vehicle is one that has been in free circulation within the UK/NI market. This effectively means most used cars sold by dealers or private sellers in Northern Ireland fit this description. This exemption makes NI a very popular place for Irish buyers to source UK imports.

How to register your imported car in Ireland

Once your car arrives in Ireland, the clock starts ticking. The registration process must be completed to make it legally roadworthy here.

1.Book an NCTS appointment: You have seven days from the date the vehicle arrives in Ireland to schedule a pre-registration inspection appointment at an NCTS facility. The appointment itself needs to be scheduled within that first week, but it can be later. Within 30 days of the car's arrival, the entire registration procedure needs to be finished.

2.Gather your documents: The complete UK V5C registration certificate (not the little tear-off slip), the invoice with the purchase date, and identification proving your name and address in Ireland (such as a utility bill) are among the documents you will need to bring to your appointment.

3.Pay VRT: After inspecting the car at the NCTS centre, Revenue will calculate its OMSP to determine how much VRT you ultimately owe. This must be paid on the day.

4.Get your plates and insurance: Once VRT is paid, you’ll be given your new Irish registration number. You can then get official Irish number plates made at any registered motor factors. Before you drive away, you must take out a new Irish insurance policy for the vehicle using its new registration.

Is it worth importing a car from the UK to Ireland?

This is the big question, and the answer isn't a simple yes or no. The route you choose for your UK import to Ireland now makes all the difference.

Bluntly speaking, for cars coming from Great Britain, the dream of bagging a cheap runaround is mostly a thing of the past. The triple-hit of Customs Duty, 23% VAT, and VRT can quickly swallow up any bargain you thought you found. For your average family car, you’ll likely find a better deal already on an Irish forecourt.

That said, if your heart is set on a rare classic, a performance model, or a car with a top-end spec you just can't find here, importing from GB might still be the only way to get it.

It’s a different story when you look north. Importing a car from Northern Ireland remains a far more appealing option. Because you get to skip the customs duty and VAT, the only major hurdle is the VRT. This keeps the costs much more manageable and makes the hunt for value genuinely worthwhile.

Ultimately, your calculator is your best friend. Before you fall in love with a car online, sit down and do the sums. Add up every potential cost, from transport to taxes, to see if the final figure really makes sense for you.